Create a pool

What You Need Before Starting

📱 Compatible Aptos Wallet

You'll need a wallet that works with the Aptos blockchain:

Petra Wallet (most popular)

Aptos Connect (Google)

Other supported wallets (shown when you click "Connect Wallet")

💰 Tokens Ready

Both tokens you want to pair (e.g., APT + USDC for an APT/USDC pool)

APT for gas fees (small amount needed for transaction costs)

Example: To create an APT/USDC pool, you need:

✅ APT tokens in your wallet

✅ USDC tokens in your wallet

✅ Extra APT for gas fees

Step-by-Step Pool Creation

Step 1: Connect Your Wallet

Go to Tapp's website

Click "Connect Wallet". Guide

Select your wallet from the list

Approve the connection in your wallet

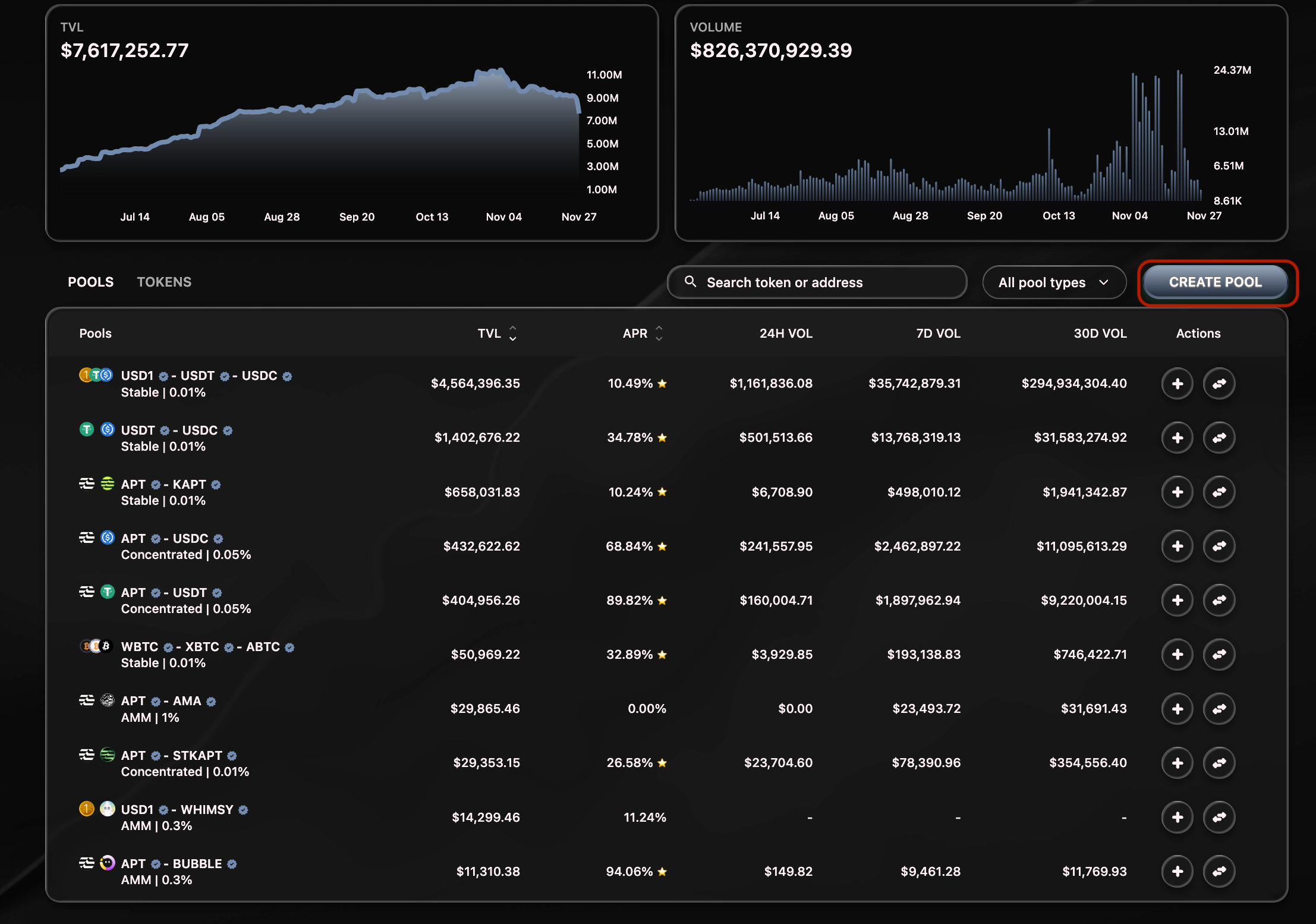

Step 2: Navigate to Pool Creation

Look for "Pools" under “Earn” in the main menu

Click "Create Pool"

You'll see the pool creation interface

Step 3: Choose Your Pool Type

🔄 Standard Pool (Recommended for Beginners)

Simple and reliable

Your liquidity works at all price levels

Good for: APT/USDC, major token pairs

Best if: You want set-and-forget liquidity

🎯 Concentrated Pool (Advanced)

Choose specific price ranges

Higher potential returns

Requires active management

Best if: You have strong price predictions

⚖️ Stable Pool (For Similar Assets)

Optimized for assets with similar values

Minimal price impact

Best if: Trading stablecoins (USDC/USDT) or staked assets

Step 4: Select Your Token Pair

First Token: Click dropdown and select (e.g., APT)

Second Token: Click dropdown and select (e.g., USDC)

The platform will show if this pool already exists

Step 5: Configure Pool Settings

For Standard Pools:

Fee Tier: Choose from available options (usually 0.05%, 0.3%, or 1.0%)

Lower fees = more trading volume

Higher fees = more earnings per trade

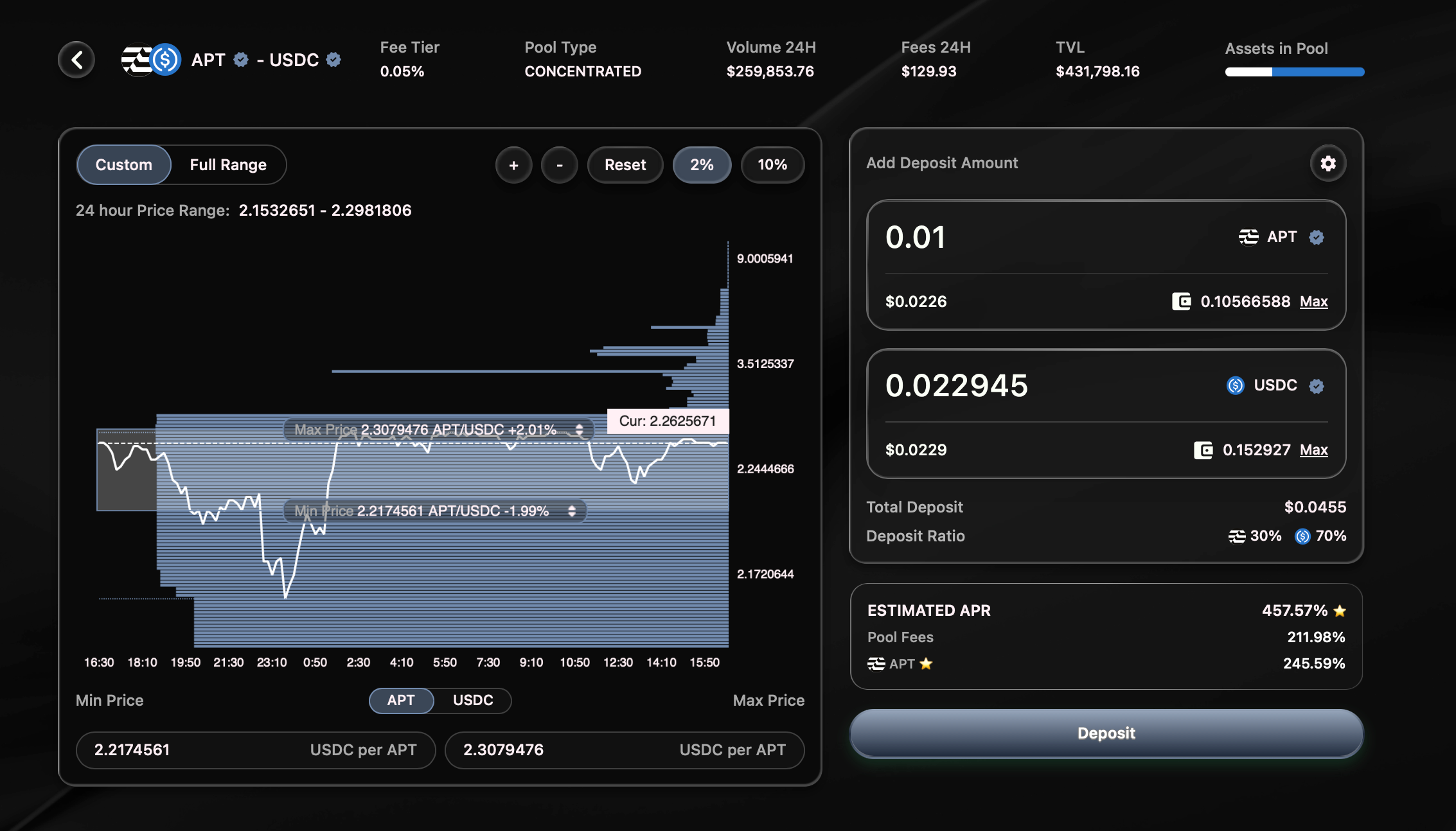

For Concentrated Pools:

Fee Tier: Same as above

Price Range: Set minimum and maximum prices

Example: APT currently $5, you might choose $3-$7 range (NFA)

Starting Price: Usually auto-filled with current market price

For Stable Pools:

Fee Tier: Usually lower (0.05% or 0.1%)

Amplification Factor: Often preset for optimal performance

Step 6: Enter Deposit Amounts

I’ll use the minimum amount to get point accrual to my LP position ~ 200$ worth of assets

How Much to Deposit:

Enter amount for first token (e.g., ~15.36 APT)

Platform automatically calculates second token amount (e.g., ~104.1 USDC)

Or enter amount for second token first

💡 Helpful Tips:

Start small for your first pool

You can always add more liquidity later

Check that you have enough tokens + gas fees

Step 7: Review Your Pool

Double-Check Everything:

✅ Correct tokens selected

✅ Pool type matches your strategy

✅ Deposit amounts look right

✅ Fee tier is what you want

✅ Price range (for concentrated pools) makes sense

Step 8: Create the Pool

Approve Token Usage: Your wallet will ask to approve spending your tokens

Click "Approve" in your wallet

Wait for confirmation

Create Pool: Click "Create Pool" button

Your wallet will ask for final confirmation

Click "Confirm" in your wallet

Wait for transaction to complete

🎉 Congratulations! Your pool is now live and earning fees! You can check your position in the Portfolio tab

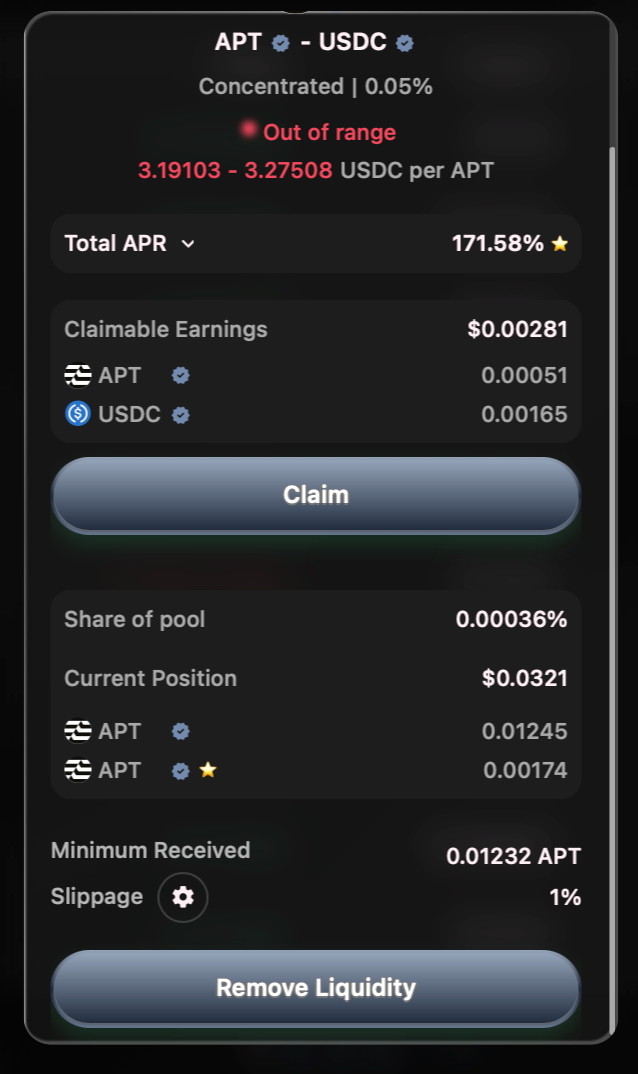

After Creating Your Pool

📊 Monitor Your Position

Check your pool's performance regularly

Watch for price movements (especially concentrated pools)

Track fees earned

💰 Manage Your Liquidity

Add more: Increase your position anytime

Remove some: Withdraw partial liquidity

Adjust range: For concentrated pools, modify price ranges

📈 Optimize Performance

Rebalance concentrated positions when needed

Consider different fee tiers based on performance

Learn from experience and adjust strategy

Common Questions

Q: Can I lose money?

A: Yes, through "impermanent loss" if token prices change significantly. However, you also earn trading fees which can offset this.

Q: Which pool type should I choose first?

A: Standard pools are best for beginners - they're simple and always active.

Q: What if I pick the wrong settings?

A: You can usually close your position and remove your liquidity and create a new one, though you'll pay gas fees.

Q: How often should I check my pool?

A: Standard pools: Weekly or monthly. Concentrated pools: Daily or weekly.

Last updated